child tax credit 2021 dates october

WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now. But many parents want to.

Irs Announced Monthly Child Tax Credit Payments To Start July 15 Forbes Advisor

Home 2021 credit october wallpaper.

. See what makes us different. 1052 AM PDT October 15 2021. Income limits associated with the expanded child credit are in effect for.

An income increase in 2021 to an amount above the 75000 150000 threshold could lower a households Child Tax Credit. The payment is 250 for a child from 6 years old to 17 years old or 300 for a child under 6 years of. October 14 2021 459 PM CBS DFW.

Ad The 2021 advance was 50 of your child tax credit with the rest on the next years return. We dont make judgments or prescribe specific policies. The IRS will send out the next round of child tax credit payments on October 15.

CBS Detroit -- The fourth Child Tax Credit payment from the Internal Revenue Service IRS goes out tomorrow. Part of the American Rescue Plan eligible parents can get half of their allowance before the. Most of us really arent thinking tax returns in mid-October.

October 20 2022. 15 by direct deposit and through the mail. The 2021 Child Tax Credit.

The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17Eligible families who did not opt-out will receive 300 monthly for each child under 6. Child tax credit 2021 october Saturday April 2 2022 Edit. File a federal return to claim your child tax credit.

Child Tax Credit Schedule 8812 H R Block. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. Well tell you all the pay dates what you need to know about missing payments eligibility and how to cancel future payments.

December 13 2022 Havent received your payment. Simple or complex always free. IR-2021-201 October 15 2021.

The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. According to CNET the payment will come when families file taxes for 2021 at the start of next year.

If you received advance payments of. 15 is a date to watch for a few reasons. Complete IRS Tax Forms Online or Print Government Tax Documents.

Tens of millions are set to get more money from the government in the form of the October child tax credit payment. Wait 5 working days from the payment date to contact us. December Child Tax Credit.

5 days since the direct. 152 PM EDT October 15 2021. If a taxpayer wont be claiming the child tax credit on their 2021.

The IRS has confirmed that theyll soon allow. The October installment of the advanced child tax credit payment is set to start hitting bank accounts via direct deposit and through the. Each payment is made on the 15th of the month.

The next chance to opt-out for the October child tax credit is October 4 by 1159pm Eastern Time. That means another payment is coming in about a week on Oct. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

Goods and services tax. There are three checks remaining this year.

Child Tax Credit 2022 How Much Money Could You Get From Your State Cnet

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

The Child Tax Credit Toolkit The White House

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger

Parents Guide To The Child Tax Credit Nextadvisor With Time

Childctc The Child Tax Credit The White House

The Child Tax Credit Toolkit The White House

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

Rising Food And Energy Prices Underscore The Urgency Of Acting On The Child Tax Credit Center On Budget And Policy Priorities

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

Child Tax Credit Payments Will Start In July The New York Times

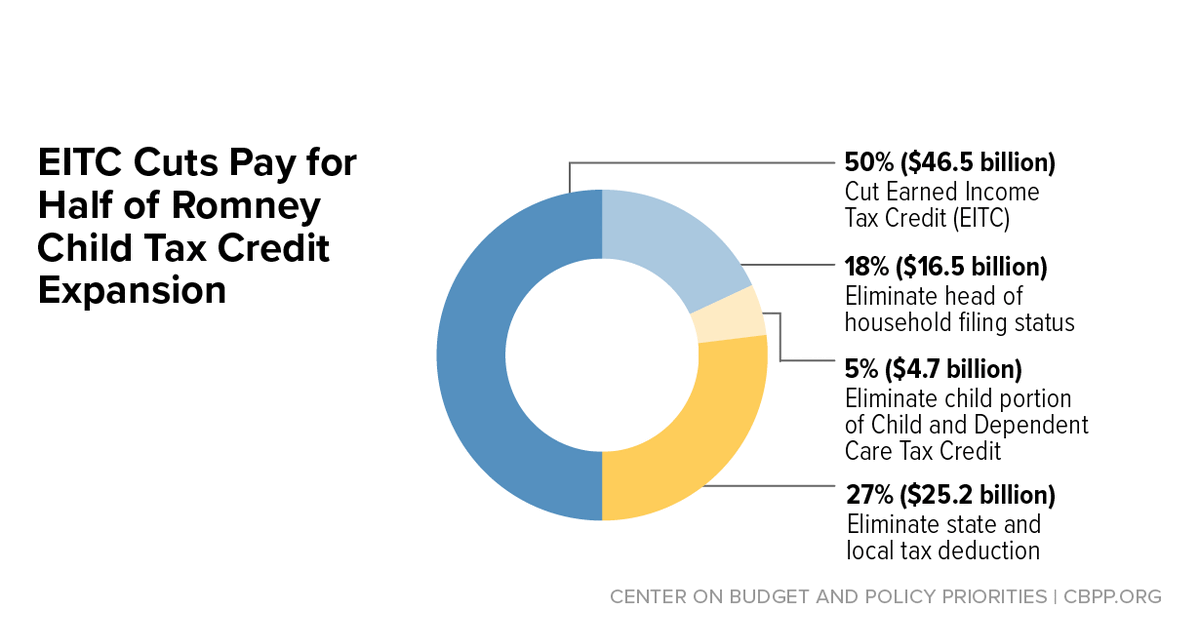

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

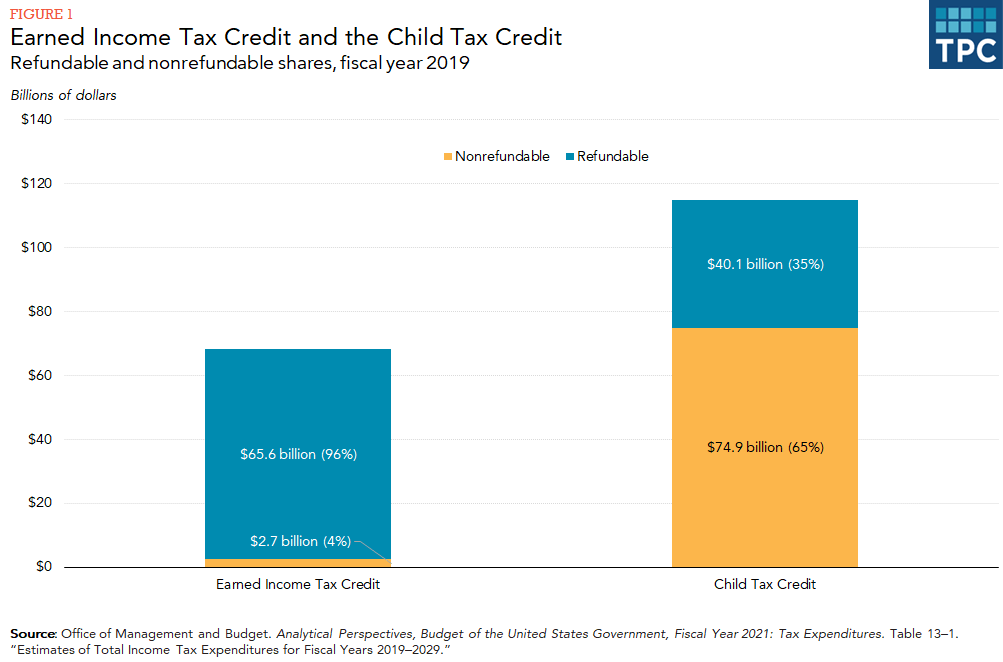

What Is The Difference Between Refundable And Nonrefundable Credits Tax Policy Center

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_image/image/70761715/1235261204.0.jpg)

Why Did Congress Let The Expanded Child Tax Credit Expire Vox